Getting Life Insurance with Kyphosis

You may have heard that getting approved for life insurance with Kyphosis will cost more.

That is sort of true but not necessarily.

If you know the right companies to apply at that will view your condition favorably.

It is a surprisingly common affliction, affecting as many as 3 million people each year. It can develop during pregnancy, but also during infancy through adolescence, while the skeletal structure is forming. But it can also happen in adults. When it does, it’s usually caused by an abnormality or a behavioral issue.

It runs the gamut, from mild to severe. Getting life insurance with kyphosis is highly likely, though higher premiums may result from more severe cases, particularly if they are untreated.

As is the case any time you have any type of health-related condition, it’s always to your advantage to work with an independent life insurance broker to find the most affordable policy.

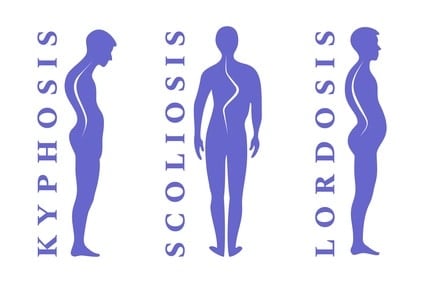

What is Kyphosis?

According to WebMD Kyphosis is an abnormally rounded upper back. It has a curvature of more than 50 degrees.

Though it normally doesn’t cause back pain, certain types of kyphosis can cause discomfort after physical activity and long periods of standing or sitting. It can cause a bending forward of the head compared to the rest of the body. It can result in a hump or curve in the upper back, or persistent fatigue in either the back or legs.

Kyphosis has a number of causes, including:

- Abnormal vertebrae development in utero (referred to as congenital kyphosis)

- Poor posture or slouching

- Scheuermann’s disease, causing the vertebrae to be misshaped

- Arthritis

- Osteoporosis

- Spina bifida, a birth defect if the spinal column of the fetus does not close completely inside the womb

- Spine infections

- Spine tumors

Given the wide range of causes, you can either be born with kyphosis, or develop it later in life.

Types of Kyphosis

Postural kyphosis is typically treated with physical therapy. It’s used to help strengthen the muscles in the back to correct posture. If pain is involved, mild pain relievers or anti-inflammatory medications are prescribed. Surgery is typically not required, however, if curvature doesn’t improve, the condition can become more serious.

In cases of Scheuermann’s kyphosis, the above treatments can be effective, but braces are usually recommended for children if there’s a curvature of at least 45°. (Braces are not recommended for adults since they are no longer growing.)

Surgery is involved only in the most severe cases. These would include uncontrolled pain, neurologic, cardiac or pulmonary complications, or a spinal curvature of more than 75 degrees. In cases where surgery is performed, it can involve using rods and screws in the vertebrae, which stabilize the spine to enable it to properly fuse.

How Life Insurance Companies See Kyphosis

Since Kyphosis is highly treatable, it’s typically not a major issue for life insurance companies. You will likely be approved for your policy, and typically at standard or preferred rates. Only when the condition is extreme is there the possibility of being charged a higher premium. This is due to the fact that complications of kyphosis could lead to more serious health conditions. But if properly managed, it’s not usually a problem.

This will particularly be true if the condition is either minor, or if it has been successfully treated in the past. If the past surgery has remedied the condition, it will be virtually a nonfactor. But naturally, any indication of recurrence could hint at some underlying cause, that the insurance company won’t be able to ignore. But usually, with proper behavioral modification, recurrence is extremely unlikely.

However, the insurance company will want to know the particulars of your kyphosis history, just as they will with any other health condition. The specifics they will pay attention to include:

- The date of diagnosis

- Cause of the condition

- Your history with the condition

- Treatment or therapies, including medications taken

- Any surgery performed

- Your response to the treatment or therapy

- Complications of the condition

- Follow up treatment, to monitor your condition on an ongoing basis

In most cases, if you haven’t experienced any severe symptoms within the past six months, your application will be approved, and at the best possible premium rate.

The insurance underwriter will closely monitor the existence of any other health conditions. If an underlying condition is responsible for kyphosis, or the result of having it, the policy will naturally be underwritten based on that particular condition.

The insurance underwriter will closely monitor the existence of any other health conditions. If an underlying condition is responsible for kyphosis, or the result of having it, the policy will naturally be underwritten based on that particular condition.

As is always the case, the overall level of your health will be carefully evaluated.

Applying For Life Insurance With Kyphosis

If you have had kyphosis in the past, and it’s been successfully treated, it shouldn’t be a concern.

As long as you are following up with your doctor, and monitoring the situation, no further action will be necessary. Naturally, the further it is in your past, the more favorable the insurance outcome will be. If a few years have passed since the last episode, you should be good to go.

When the condition is current, the severity will be the main focus.

If it is causing other health conditions, it might be best to have your kyphosis treated before applying for life insurance. The insurance company will be better able to analyze the impact of the condition. After six months or a year, it will be known if surgery is successful, and if there will be any complications involved in the recovery.

If kyphosis is moderate or well-controlled, you should receive a standard or even a preferred rating. If it’s more severe, or if the underlying cause is not known, your application will likely be approved, but with a substandard rating.

Life insurance companies are most concerned that an advancing kyphosis condition, or one left untreated, could lead to heart, respiratory, or digestive problems. Those are more serious, and would materially affect the underwriting of your application.

As is always the case anytime you have any type of health condition, it’s important to make sure that you are proactive in managing your overall health. If you’re otherwise healthy, your life insurance prognosis is excellent. If you have other conditions, the outcome may change.

Be sure that you are proactive in any follow-up treatment for kyphosis. Also make sure that you’re getting regular exercise, eating a balanced diet, regularly monitoring your weight and blood pressure, and seeing your doctor regularly.

An Independent Insurance Broker is Your Best Friend if You Have a History of Kyphosis

With some insurance companies, kyphosis could be an issue.

It’s unlikely that you’ll be declined if kyphosis is your only condition. But there’s an excellent chance you will be charged a higher premium with kyphosis. That’s because some companies do consider it to be a significant issue. Those are the companies you’ll want to avoid making an application with.

However, there are life insurance companies that take a benign view of kyphosis. Not only will they approve your application, but they’ll give you a preferred rating if your case is moderate or well-managed. Even if it’s severe, you may receive nothing lower than a standard rating.

The difference in premiums that you will pay between the two types of insurance companies, can be significant. It can be several hundred dollars per year, depending upon the amount of life insurance you are applying for.

As a consumer, it’s very unlikely you’ll know who the better companies are. There are scores of life insurance companies, and they don’t make public their health condition preferences.

Only an experienced life insurance broker can help you with that. Since we work with these companies on a regular basis, we understand their nuances. We know the companies that take the more favorable view of kyphosis, and a wide range of other health conditions. If you apply through us, we’ll make sure your application gets to those companies.

And our services won’t cost you any more than what you will pay if you apply directly to life insurance companies yourself.

If you have a history of kyphosis, or any other health condition, give us a call or complete the brief application to the left. Finding affordable life insurance policies for people with health conditions is what we do every day. Let us help you!